2025 Salary Guide for

Nannies & Household Staff

Hiring the right support for your home is no longer just about availability. In 2025, families across Australia are weighing salary expectations, legal entitlements, and the real value of experienced childcare professionals. The market has shifted: demand is rising, Fair Work minimums have increased, and families are discovering that clarity on pay is the first step to peace of mind.

At the Australian Nanny Agency, we believe in transparency. This guide explains what families can expect to pay for nannies, mother’s helpers, maternity nurses, and household staff from hourly rates to entitlements with insight into why salaries are climbing and how to budget with confidence.

The New Landscape of Pay in 2025

This year, the national minimum for household staff rose, setting a new benchmark under Fair Work. But in practice, families rarely secure a qualified nanny or maternity nurse at that base rate

Instead, professional nannies are commanding $40–$50 per hour, while maternity nurses often reach $45–$55.

Mother’s helpers remain a flexible option for families who need support without the full cost of a career nanny, averaging $38–$45 per hour. At the top end of the spectrum, governesses and specialist educators can exceed $50 per hour, reflecting both qualifications and scarcity.

Rates are not uniform. A family in Sydney or Melbourne should expect to budget more than one in Adelaide or Brisbane, driven by both cost of living and competition for talent. Understanding these differences is critical for families planning long-term childcare arrangements.

Why are Rates Are Rising

Pay rates in 2025 reflect more than inflation. The Fair Work Commission’s annual uplift pushed minimum wages higher across all categories, while demand for experienced childcare professionals has surged. Families balancing dual careers, hybrid work, and multiple children are increasingly turning to in-home staff.

As a result, the nanny market is operating above the baseline. While Fair Work defines the minimum, families often need to pay more to secure long-term, reliable professionals particularly in metropolitan areas where the cost of living is highest.

Salary Insights by Role

Daily live out nanny

The foundation of private childcare, nannies remain the most sought-after role.

- $42–$48/hr, with full-time weekly costs exceeding $87,000 annually including entitlements.

Mother’s Helpers

Working alongside parents, mother’s helpers are gaining popularity.

- They earn $38–$45/hr, supporting families during school holidays, newborn stages, or work-from-home arrangements.

Maternity Nurses

Specialists in newborn care, maternity nurses

- average $45–$55/hr.

Overnight packages and structured schedules make them indispensable for families welcoming a baby.

Governesses and Educators

Providing curriculum support and often living in,

- governesses exceed $50/hr, blending teaching expertise with childcare.

Family Assistants

Family Assistants bridge the gap between childcare and household management. Their role often includes school runs, scheduling, meal preparation, and light administration also expect light cleaning and housekeeping support tidying common areas, managing laundry, or keeping kitchens and playrooms in order.

- expect to pay $40–$48 per hour. These roles are ideal for busy households where parents need both childcare and domestic support rolled into one trusted professional.

House Managers

House Managers oversee the smooth running of a household, often supervising other staff. They coordinate maintenance, manage budgets, and ensure day-to-day operations are seamless. Salaries in Australia

- range from $45–$60 per hour, with live-in arrangements negotiated at higher packages.

Domestic Staff Roles

Domestic Couples

Domestic Couples are hired together, often to run estates, farms, or large properties. Duties can include cooking, housekeeping, gardening, and property maintenance. Rates vary depending on skills but typically

- average $80–$100 per hour combined, or $40–$50 each.

- Live-in packages are common, with accommodation provided.

Private Chefs

Families seeking a Private Chef should budget $45–$70 per hour, or annualised packages for full-time placements. Private Chefs cater to dietary needs, weekly meal planning, events, and often travel with the family. This role has grown in demand as families prioritise health and bespoke dining.

Chauffeurs and Drivers

Professional drivers offer safety, discretion, and reliability. In Australia, Chauffeurs average $38–$50 per hour, with additional costs for overtime, weekend work, or split shifts. Families employing drivers often do so alongside other household staff for seamless daily logistics.

Housekeepers

Housekeepers remain one of the most frequently requested roles. Depending on duties, they earn $35–$45 per hour, with higher rates for those offering cooking, laundry management, or childcare support in hybrid roles. Full-time housekeepers are increasingly hired by dual-income families seeking balance and order at home.

Governesses and Educators

At the top of the childcare spectrum, Governesses provide structured education and tutoring. With teaching qualifications, they command $50–$65 per hour, and are often placed in UHNW households or families requiring home schooling.

Estate Staff Packages

Larger properties often require a combination of roles house manager, grounds staff, domestic couple, or nanny-chef arrangements. For families hiring multiple staff, agencies generally negotiate packages. As a guide, Australian families should budget $120,000–$200,000 annually for multi-staff households, depending on scope.

Discover Professional Nanny Services in Australia

State-by-State Pay

The national averages mask local variations. Families in NSW and WA face rates close to $39/hr, while South Australia remains more affordable at $35.50/hr. Relocating families should consider these differences when budgeting.

Entitlements Every Family Must Pay

Hiring a nanny is hiring an employee. Under Fair Work, families must provide:

- Pro-rata annual leave

- Sick leave and carer’s leave

- Superannuation (11%)

- Minimum 3–4 hour shifts

- Public holiday pay and overtime where relevant

These are not optional. Families who fail to comply risk penalties and undermine trust with staff.

The Cost of Care

At $42 per hour, a 40-hour nanny costs around $1,680 per week plus super, totalling nearly $96,000 annually with entitlements. While the investment is significant, it delivers stability, continuity, and professional standards that casual babysitting cannot match.

Families Share Their Experience

Lucy, Brisbane

“When our second baby was born, I panicked at the cost. Seeing the real salary expectations upfront helped me hire with confidence.”

Samir, Melbourne

“With twins and remote work, I needed flexible help. The salary guide showed me how to structure the role fairly.”

Placement Fees

To support families in making the right choice, the Australian Nanny Agency charges transparent fees:

- Casual trial bookings: from $55 per day

- Permanent placement fees: from $1,000 depending on role

These fees cover reference checks, interviews, and matching to ensure compliance and peace of mind.

.

National Average Hourly Rates

While these figures reflect the minimum benchmark rates, families should be aware that the average pay for an experienced nanny sits closer to $40 per hour, plus superannuation. Highly qualified nannies with strong references, childcare credentials, or additional household responsibilities often command this higher rate, particularly in metropolitan areas where demand is strongest.

Why Are Nanny Rates Increasing?

1. National and State Movements

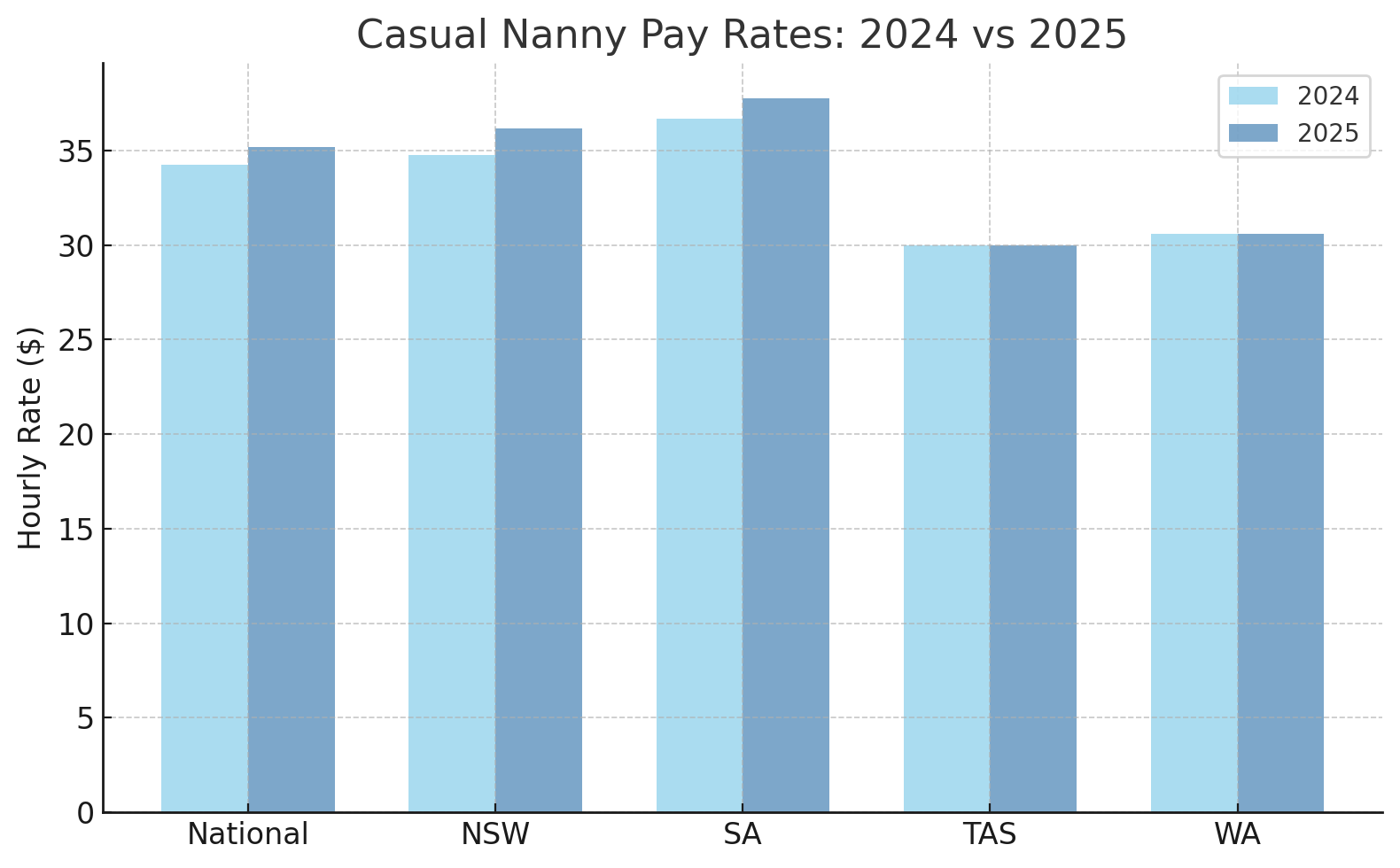

The national casual average has lifted from $34.26 in 2024 to $35.19 in 2025 (+2.7%).

- Biggest jumps: NSW (+4%) and SA (+3%).

- Smallest changes: TAS ($30.00) and WA ($30.59).

2. Key Drivers Behind 2025 Pay Levels

- Inflation pressures: Families are paying more to keep pace with rising costs of living.

- High demand: A shortage of qualified nannies, particularly in cities, is pushing wages up.

- Award adjustments: The 2024 increase to the Miscellaneous Award created a higher wage floor.

3. Comparison with Award Wages

From July 2024, the Miscellaneous Award minimum for casuals (Level 1) was $25.94 per hour. Actual nanny rates sit well above this benchmark, reflecting strong competition for experienced carers. For permanent roles, the award is even lower, showing the premium families are prepared to pay for reliable childcare.

4. Additional Insights

- Urban vs Regional: Sydney and Melbourne drive up averages in NSW and VIC, while regional states sit lower.

- Role complexity: Families often combine nannying with house management, adding to the rate.

- Superannuation: With contributions moving to 12% in July 2025, families are factoring this cost into hourly pay.

Why Pay Differs by State

- Living costs: Higher expenses in NSW and VIC lift rates.

- Childcare demand: Dual-income and professional households create stronger competition for nannies.

- Local frameworks: State uptake of award benchmarks and compliance influences rate setting.

What Families Should Factor In

When setting a rate, consider

- Experience & training: Qualified, seasoned carers earn more.

- Duties required: Extra household support or driving duties increase pay.

Family budget: Balancing affordability with competitiveness is key.

Beyond wages, families also need to plan for

- Paid leave and sick pay.

- Superannuation.

- Workers’ compensation insurance.

- Vehicle insurance (if the nanny drives your car).

Employment Types & Pay Breakdown

Casual Employment

Definition: Irregular or flexible hours, no guaranteed ongoing work, higher hourly rate to compensate for lack of leave entitlements. Casuals are paid a “casual loading.”

Example:

Mia works for the Johnson family

two afternoons a week during school term only. If they don’t need her next week, there’s no obligation to offer shifts, and she doesn’t get paid sick leave or annual leave.

Permanent Full-Time

Definition: Ongoing employment at 38 hours per week (standard full-time load), entitled to paid annual leave, sick leave, super, and other benefits.

Example:

Sarah works

Monday–Friday, 9am–5pm for the Smith family. She’s on payroll, gets

four weeks’ annual leave, 10 days’ sick leave, and superannuation.

Permanent Part-Time

Definition: Ongoing employment, less than 38 hours per week, with a regular agreed pattern of hours. Entitled to leave and super on a pro-rata basis.

Example:

Emma works

Tuesday–Thursday, 9am–3pm every week for the Lee family. Her hours are consistent, she’s entitled to

part-time sick and annual leave, and the family pays her super.

👉 Key Difference:

- Casual = flexible but no security.

- Permanent = secure, with entitlements.

- Part-time = secure, regular pattern, fewer hours.

This guide is here to give you a clear picture of what’s fair and competitive. Salaries will always shift with experience, skills, and market demand, but keeping informed helps you make confident choices. At the end of the day, fair pay isn’t just about numbers it’s about valuing people and building strong, lasting teams.